Medium long term double bottom/top formations have low predictive power

Published 24 March 2017

Double bottom and double top formations in Investtech's medium long term charts have low predictive power. This is shown in a research report from Investtech based on 11 years of data from the Stockholm Stock Exchange in Sweden.

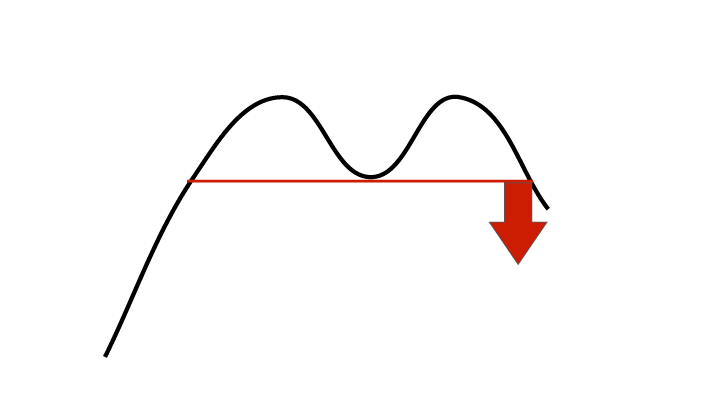

A double top formation is a top formation which marks the end of a rising period. The formation consists of two tops of approximately the same width and height, see figure 1. The formation of a double top mirrors increasing pessimism among investors and signals the beginning of a falling trend. Double top formations are especially useful in predicting long term market trend reversals, but are also used in the shorter term.

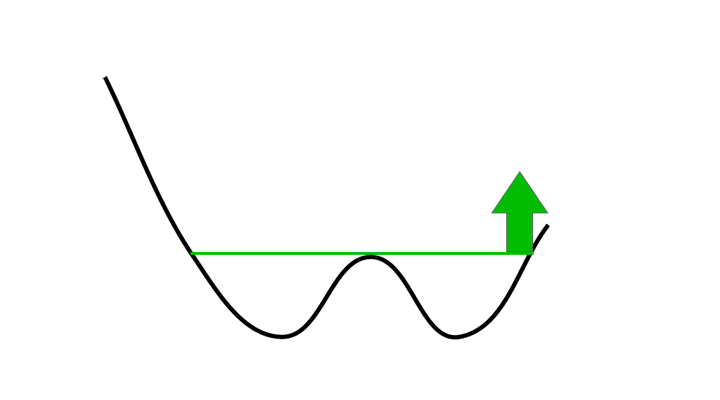

There is an opposite version of this formation; the double bottom formation, see figure 2. This is a bottom formation which marks the end of a falling period. A double bottom formation signals increasing optimism among investors and the start of a rising trend.

Figure 1: Sell signal from double top formation.

Figure 2: Buy signal from double bottom formation.

In technical analysis terminology, a break down from a double top formation triggers a sell signal. Similarly a break upwards from a double bottom formation triggers a buy signal.

We have studied the price movements that have followed such buy and sell signals on Sweden's Stockholm Stock Exchange in a period of 11 years, from 2003 to 2014.

Investtech’s computers identified 876 buy signals from double bottom formations and 1215 sell signals from double top formations in medium long term charts in this period.

Figure 3: Price development after buy and sell signals from double bottom and double top formations on the Stockholm Stock Exchange identified by Investtech’s automatic algorithms in medium long term price charts. Click the image for bigger version.

The chart shows average price development 66 days after buy signals from double bottom formations and sell signals from double top formations. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately 3 months. Buy signals are the blue line and the sell signals are the red one. The shaded areas show the standard deviation for these calculations. The black line is the benchmark index.

Figure 3 shows that both buy and sell signals have been followed by price development in line with average benchmark development. There are some differences, but the buy and sell signals differ in the same direction and based on statistical t-values they are not statistically significant.

Read the complete research report here (in Swedish).

Verfasst von

Forschungs- und Analysechef

Investtech

"Investtech analysiert die Psychologie des Marktes und macht Ihnen täglich konkrete Tradingvorschläge."

Partner & Senior Advisor - Investtech

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices