Buy signals from rectangle formations gave 6.2 per cent in three months

Research results from Investtech, 4 November 2014

Published in English on 9 December 2014. Norwegian original here >>

A research report from Investtech based on 19 years of data from the Oslo Stock Exchange in Norway shows that buy signals from rectangle formations statistically gave a price increase of 6.2 per cent in the three months following the signal. A similar study of rectangle formations on the Stockholm Stock Exchange in Sweden shows that buy signals there gave 5.8 per cent in three months.

Rectangle formations are created in stock prices when buyers and sellers of the stock are balanced over time. Technical analysis theory suggests that investor psychology is about to change when the price breaks out from such formations.

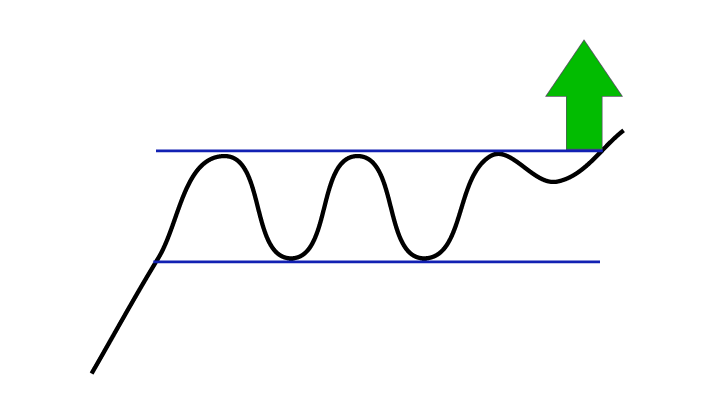

Figure 1: Buy signal from rectangle formation.

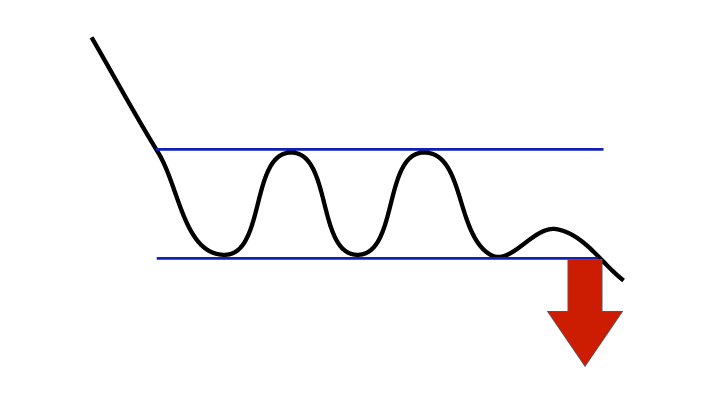

Figure 2: Sell signal from rectangle formation.

A break upwards from a rectangle formation triggers a buy signal and a break downwards triggers a sell signal. Investtech’s Head of Research, Mr. Geir Linløkken, has studied the price movements that have followed from buy and sell signals from rectangle formations on the Oslo Stock Exchange over a period of 19 years, from 1996 to 2014.

Investtech’s computers identified a total of 1,084 buy signals and 776 sell signals in this period.

Price development following buy and sell signals from rectangle formations on the Oslo Stock Exchange identified by Investtech’s automatic algorithms in medium term charts. Click the image for bigger version.

The chart shows average price development following buy and sell signals from rectangle formations. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately 3 months. Buy signals are the blue line and the sell signals are the red one. The shaded areas show the standard deviation for these calculations. The black line is the benchmark index.

On average, stocks with buy signals increased by 6.2 % after 3 months, whereas stocks with sell signals fell by 0.3 %. Compared to the average stock exchange development in the same period, the buy signals did 2.9 percentage points better and the sell signals did 3.0 percentage points worse.

Click here to read the complete research report for the Oslo Stock Exchange.

The same study was carried out on data from the Stockholm Stock Exchange in Sweden. The research report shows that stocks with buy signals on average increased by 5.8 % after three months. Stocks with sell signals increased by 3.0 %. Compared to the average stock exchange development in the period, stocks with buy signals did 2.0 percentage points better, and stocks with sell signals did 0.8 percentage points worse.

Click here to read the complete research report for the Stockholm Stock Exchange.

Keywords: Buy signal,Oslo Stock Exchange,Rectangle pattern,Sell signal,statistics,Stockholm Stock Exchange.

Verfasst von

Forschungs- und Analysechef

Investtech

Insight & Skills:

Buy signal from rectangle formation

Sell signal from rectangle formation

Buy signals from rectangle formations - how often are they succesful?

"Investtech analysiert die Psychologie des Marktes und macht Ihnen täglich konkrete Tradingvorschläge."

Partner & Senior Advisor - Investtech

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices