Trading opportunities

Stock prices occasionally exhibit combinations of technical indicators that strongly predict large price movements. Such combinations rarely occur, but when they do, there are often opportunities for very profitable trades. We call this trading opportunities. Stocks with trading opportunities will often have a high upside while the downside is low.

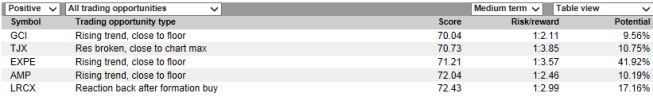

Investtech’s systems identify ten different kinds of trading opportunities. When you select Trad. opportunities from the left-hand menu, all the different kinds of trading opportunities are shown in the list. Select a particular kind from the table header. You can choose between short term, medium term and long term trading opportunities.

The following information is given for each stock in the list:

Score: Every trading opportunity is given a score between 0 and 100. This score is shown in both the tables and on the details pages. The higher the score, the better the stock satisfies the criteria that theoretically define the trading opportunity, and the better the possibility to make a profitable trade with the stock. Note that several of the technical indicators that we measure per stock are not included in the computation of score for trading opportunities. Some of these, such as support and resistance, trend direction and volume balance, can be very important for the technical outlook of a stock. The trading opportunities with the highest scores will therefore not automatically be the best trades. We therefore recommend that users look at the whole picture, short and long term, and for example also evaluate fundamental information before trading. Kindly note that risk is not included in the calculation of the score. Two stocks with the same score can have very different risks. Stocks with very low liquidity will be excluded from trading opportunities, but the liquidity requirements to be included in trading opportunities are relatively low. Only trading opportunities with a score of 70 or higher are listed. Institutional users can change this limit under "Profile".

Risk/reward ratio: The risk/reward ratio is calculated as the upside potential vs. the downside potential, i.e. the reward of a successful investment (selling at target price) compared to the result in case of a failed investment (selling at stop loss). The downside potential is always set to 1, so the higher the upside potential, the higher the return.

Potential: Upside, measured in percentage. Calculated as increase in percent from recommended buy price to target price. Note that stocks with a high upside also tend to be high risk.

Access a specific trading opportunity to see recommended buy price, target and stop loss. You get concrete suggestions for where to buy and sell the stock, and the opportunity to consider upside vs. downside. Also listed are a presumed time horizon for the investment and conditions that strengthen or weaken the stock.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Die Anlageempfehlungen werden von Investtech.com AS ("Investtech") ausgearbeitet. Investtech übernimmt keine Haftung für die Vollständigkeit oder Richtigkeit der jeweiligen Analyse. Ein etwaiges Engagement aufgrund der aus den Analysen resultierenden Empfehlungen/Signale erfolgt zur Gänze für Rechnung und Risiko des Anlegers. Investtech haftet nicht für Verluste, die sich direkt oder indirekt infolge der Nutzung von Investtechs Analysen ergeben. Angaben zu etwaigen Interessenkonflikten gehen stets aus der Anlageempfehlung hervor. Weitere Informationen zu Investtechs Analysen finden Sie unter disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices