Norsk Hydro (NHY.OL)

Algorithmic Overall Analysis

Positive (Score: 77)

Apr 25, 2025. Updated daily.

Analyst's Recommendation

Negative

Apr 15, 2025. 11 days ago.

Analyses

Short

Medium

Long

Overall

Insider

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Stock data

| Price date | Apr 25, 2025 |

| Currency | NOK |

| ISIN | NO0005052605 |

| Rise from year low | 8.99% |

| Fall from year high | -22.09% |

Automatic technical analysis. Short term

Short term

Norsk Hydro has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The stock has support at kroner 52.00 and resistance at kroner 62.40. The stock is assessed as technically neutral for the short term.Recommendation one to six weeks: Hold (Score: -8)

Automatic technical analysis. Medium term

Medium term

Norsk Hydro has broken the floor of the rising trend channel in the medium long term, which indicates a weaker initial rising rate. The stock has broken up through resistance at kroner 55.20. This predicts a further rise. In case of negative reactions, there will now be support at kroner 55.20. The short term momentum of the stock is strongly negative, with RSI below 30. This indicates increasing pessimism among investors and further decline for Norsk Hydro. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The stock is overall assessed as technically positive for the medium long term.Recommendation one to six months: Positive (Score: 82)

Automatic technical analysis. Long term

Long term

Investors have paid higher prices over time to buy Norsk Hydro and the stock is in a rising trend channel in the long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. The price has reacted back after a false break of the rectangle formation. A significant penetration of 54.89 will again give new negative signals to the stock, while a break of the opposite side of the formation will be a strong positive signal. The stock has marginally broken up through resistance at kroner 56.00. An established break predicts a further rise. The stock is overall assessed as technically positive for the long term.Recommendation one to six quarters: Positive (Score: 55)

Full history

Candlesticks 95 days

Candlesticks 22 days

Insider Trades

Insider trades reported last 18 months. The stock is slightly positive on Insider Trades.

| Date | Type | Count | Price | Value | Percent | Controlled | Text | Importance |

|---|---|---|---|---|---|---|---|---|

| Mar 26, 2025 | kjøp | 1000 | 66.99 | 66 | 100 | 1000 | Styremedlem Jane Toogood kjøper 1000 | 65 |

| Jul 24, 2024 | kjøp | 6200 | 61.42 | 380 | 23 | 26700 | Styremedlem Rune Bjerke kjøper 6200 | 91 |

| Jun 3, 2024 | kjøp | 6800 | 69.34 | 471 | 68 | 10000 | Styremedlem Espen Gundersen kjøper 6800 | 100 |

Commentaries

Automatic technical analysis of the stock, based on last closing price. The chart may have changed since the analyst's recommendation was written.

Analyst's Recommendation

Apr 15, 2025 (11 days ago)Kari Poblete

info@investtech.com

Kari Poblete, Apr 15, 2025 (price 54.06)

Norsk Hydro ligger i en tilnærmet horisontal trendkanal på mellomlang sikt og videre utvikling i samme retning indikeres. Aksjen ga imidlertid salgssignal fra en rektangelformasjon ved bruddet ned gjennom støtten ved 55.75 kroner. Videre nedgang til 44.14 kroner eller lavere er signalisert.Aksjen har også gitt salgssignal fra glidende snitt-indikatoren og nærmer seg motstanden ved cirka 55.20 kroner, noe som også kan gi en reaksjon ned. Det kortsiktige momentumet i aksjen er sterkt negativt, med RSI under 30. Det indikerer økende pessimisme hos investorene og videre kursnedgang for Norsk Hydro. Spesielt i store aksjer kan imidlertid lav RSI være tegn på at aksjen er oversolgt, og at det er mulighet for en reaksjon opp. Aksjen anses samlet sett teknisk negativ på mellomlang sikt. Norsk Hydro er positiv på innsidehandler etter ett kjøp i mars.

Published: Morning Report (Apr 15, 2025 07:40) [KP]

Previous recommendations

Fredrik Dahl Bråten, Mar 23, 2025 (price 66.08)

Norsk Hydro har siden våren 2022 slitt med å bryte opp gjennom motstanden ved 73 kroner. Kursen har nærmet seg nivået en rekke ganger, for så å vende ned igjen. Flere investorer anser trolig aksjen her som dyr, og vil selge om kursen skulle stige opp til motstanden igjen. Bryter aksjen derimot opp gjennom nivået vil kursen kunne stige raskt videre, siden de fleste som ønsker å selge aksjen statistisk da allerede har solgt. Kjøperne av aksjen kan da uten motstand drive prisen raskt oppover. Kursen har etablert seg innenfor en rektangelformasjon på lang sikt og har beveget seg horisontalt i flere år. Brudd opp vil utløse et kjøpssignal for Norsk Hydro, men tilsvarende vil brudd ned under 56 kroner utløse et salgssignal.

Recommendation one to six months: NeutralPublished: Morning Report (Mar 23, 2025 23:10) [FDB]

Kari Poblete, Jan 14, 2025 (price 65.32)

Investorene har over tid betalt stadig høyere priser for å kjøpe seg opp i Norsk Hydro og aksjen ligger i en stigende trendkanal på mellomlang sikt.

Aksjen beveger seg i en rektangelformasjon mellom støtte på 55.02 kroner og motstand på 73.24 kroner. Etablert brudd på et av disse nivåene vil signalisere videre retning. Negativ volumbalanse viser at volumet er høyere på nedgangsdager enn på oppgangsdager. Det indikerer at optimismen er avtagende hos investorene. Aksjen anses samlet sett teknisk nøytral på mellomlang sikt.

Published: Morning Report (Jan 14, 2025 08:09) [KP]

Analysts' recommendations last 18 months

| Evaluation | Time horizon | Price | Published | Analyst |

|---|---|---|---|---|

Negative Negative | Medium term | 54.06 | Apr 15, 2025 07:40, Morning Report | KP |

Neutral Neutral | Medium term | 66.08 | Mar 23, 2025 23:10, Morning Report | FDB |

Neutral Neutral | Medium term | 65.32 | Jan 14, 2025 08:09, Morning Report | KP |

Weak Positive Weak Positive | Short term | 65.58 | Sep 24, 2024 19:42, e24 | FDB |

Weak Positive Weak Positive | Medium term | 65.58 | Sep 24, 2024 19:37, Morning Report | FDB |

Positive Positive | Medium term | 59.66 | Aug 21, 2024 15:36, e24 | AT |

Weak Positive Weak Positive | Medium term | 66.48 | Jul 16, 2024 08:38, Morning Report | GL |

Negative Negative | Medium term | 56.16 | Feb 25, 2024 18:23, Morning Report | FDB |

Weak Negative Weak Negative | Medium term | 65.50 | Jan 12, 2024 07:47, Stay Away Portfolio | GL |

Negative Negative | Medium term | 62.78 | Dec 1, 2023 08:21, Stay Away Portfolio, e24 | GL |

Negative Negative | Medium term | 63.06 | Nov 29, 2023 23:33, Morning Report | FDB |

Negative Negative | Medium term | 62.34 | Oct 17, 2023 10:32, Morning Report, Today´s Case | KP |

AT: Asbjørn Taugbøl (Analyst)

FDB: Fredrik Dahl Bråten (Analyst)

GL: Geir Linløkken (Head of Analyses)

KP: Kari Poblete (Analyst)

Results analysis

Average price development

Results publications in price chart

Results publications last 18 months

| Percentage change days before publication | Percentage change days after publication | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Publication date | Description | 22 d | 10 d | 5 d | 1 day | Publication | 1 day | 5 d | 10 d | 22 d |

| Average last 5 results publications | 3.35 | -2.04 | -2.99 | -0.55 | -1.97 | 0.80 | -0.10 | -0.58 | 3.93 | |

| Average last 20 results publications | 1.44 | 0.42 | -0.88 | 0.16 | 0.27 | 0.17 | 0.90 | 1.41 | 6.91 | |

Seasonal variations

Seasonal prediction from today's date

Monthly and annual statistics

Average development per month, last 10 years

Average development throughout the year, last 10 years

Annual development from 2015 to 2024

Trading limits

Average price development quarter by quarter past 66 trading days

Estimated price today

| Opening | 55.42 |

| High | 55.79 |

| Low | 55.05 |

| Close | 55.34 |

| Opening to high | 0.67% |

| Opening to low | -0.67% |

| Opening to close | -0.14% |

Early warning

Alerts

| Date | Price | Trading opportunity | Time span | Target |

|---|---|---|---|---|

| Apr 25, 2025 | 56.50 | Oversold, close to sup | Medium term | 64.25 - 67.75 |

Key ratios

Dividend yield: 3.6%

P/E: 22.1

P/S: 0.5

P/B: 1.0

Dividend per share: 2.21

Earnings per share: 2.51

Revenue per share: 101.36

Book value per share: 53.48

Market cap million NOK: 111 460.

Financial data

| MNOK | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 87 694 | 81 953 | 109 220 | 159 377 | 149 766 | 138 118 | 149 654 | 207 929 | 193 619 | 203 636 |

| Profit for the year | 2 333 | 6 586 | 9 184 | 4 480 | -1 811 | 3 560 | 13 942 | 24 417 | 2 804 | 5 040 |

| Profit margin | 2.7 % | 8.0 % | 8.4 % | 2.8 % | -1.2 % | 2.6 % | 9.3 % | 11.7 % | 1.4 % | 2.5 % |

| Book value | 74 170 | 81 907 | 87 074 | 85 990 | 79 933 | 76 179 | 84 064 | 107 798 | 107 182 | 107 452 |

| Equity ratio | 64.7 % | 67.0 % | 56.5 % | 56.2 % | 51.1 % | 47.7 % | 50.6 % | 54.3 % | 51.9 % | 51.8 % |

| Revenue per share | 42.97 | 40.13 | 53.43 | 77.90 | 73.16 | 67.44 | 72.33 | 100.50 | 93.58 | 103.02 |

| Book value per share | 36.34 | 40.11 | 42.60 | 42.03 | 39.05 | 37.20 | 40.63 | 52.10 | 51.80 | 54.36 |

| Earnings per share | 1.16 | 3.28 | 4.57 | 2.23 | -0.90 | 1.77 | 6.94 | 12.15 | 1.40 | 2.51 |

| Dividend per share | 1.02 | 1.27 | 1.78 | 1.27 | 1.27 | 1.27 | 5.56 | 5.82 | 2.57 | 2.21 |

| Dividend payout | 89 % | 39 % | 40 % | 58 % | -144 % | 73 % | 83 % | 49 % | 190 % | 87 % |

Dividend yield

Dividend yield for NHY is 3.6%.

P/E - price/earnings

P/E for NHY is 22.1.

P/S - price/sales

P/S for NHY is 0.5.

P/B - price/book

P/B for NHY is 1.0.

Help and information - Research shows the importance of Trend, Momentum and Volume

Investtech’s analyses focus on a stock’s trend status, short term momentum and volume development. These are central topics of technical analysis theory that describe changes in investor optimism or fluctuations in a company’s financial development. However, Investtech’s strong focus on these elements is due to research results that clearly indicate causation between these factors and future return on the stock market.

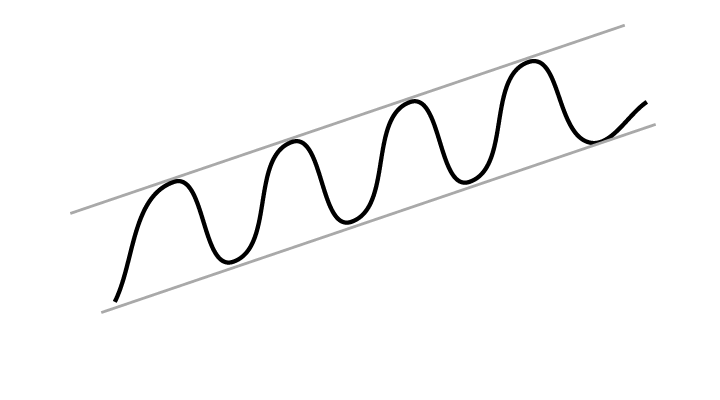

Trend

Theory: Stocks in rising trends will continue to rise.

Psychology/economy: Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Read more

Research: Stocks in rising trend channels in Investtech’s medium long term charts have been followed by an annualized excess return of 7.8 percentage points compared to average benchmark development. This is shown by Investtech’s research into 34,880 cases of stocks in rising trends on the Nordic Stock Exchanges in the period 1996 to 2015.

Read more about the research results here

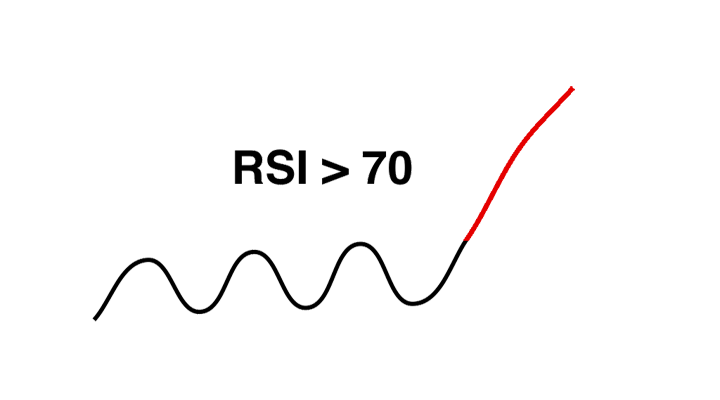

Momentum

Theory: Stocks with rising short term momentum will continue to rise. Stocks with very strong momentum (overbought) will react backwards.

Psychology/economy: RSI above 70 shows strong positive momentum. The stock has risen in the short term without any significant reactions downwards. Investors have kept paying more to buy stocks. This indicates that more investors want to buy the stock and that the price will continue to rise. Read more

Research: Stocks with strong momentum have on average continued to rise, and more so than the average stock listed on the Exchange. This is shown by Investtech’s research into 24,208 cases of stocks on the Nordic Stock Exchanges in the period 1996 to 2015 where RSI went above 70 points, indicating strong and increasing short term momentum. On average, annualized, the stocks rose the equivalent of 11.4 percentage points more than the average stock.

Read the research report here

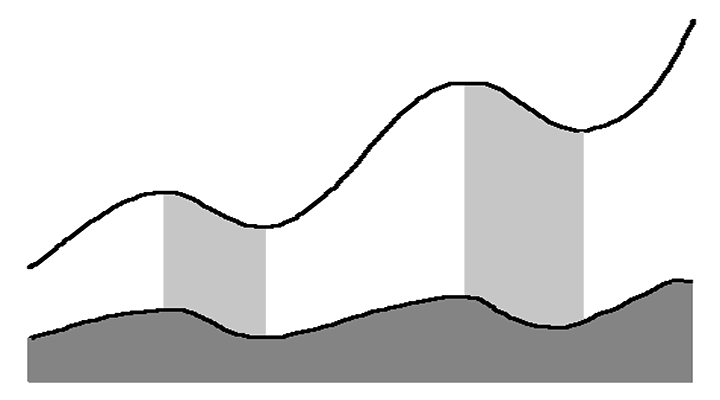

Volume

Theory: Rising prices on high volume and falling prices on low volume indicate strength in a stock. Volume can confirm a rising trend or signal that a falling trend is ending.

Psychology/economy: When investors very much want to buy a stock, they have to increase the price to find new sellers. Rising price on high volume shows that some investors are so aggressive that they push the price up to be able to buy the stock. Investtech’s Volume Balance tool measures the relation between price rise and volume and measures investor aggression at rising and falling prices. Read more

Research: Stocks with volume balance above 40 have been followed by an average annual return of 4.7 percentage points on the Nordic Stock Exchanges, shown by research conducted by Investtech into 24,580 cases.

Read the research report here

Investtech's analyses

Investtech has combined theory, psychology and research into powerful investment tools.

About Investtech

Investtech are behavioural finance and quantitative stock analysis specialists. The company sells analysis products to private, professional and institutional investors. Investtech manage the AIFM company Investtech Invest, which invests customers’ funds in the stock market.

Investtech’s computers analyze more than 28,000 stocks from 12 different countries every day. The analyses are presented in eight languages and sold to customers worldwide. In addition to the automatic analyses, the company’s analysts present subjective assessments and recommendations for some markets. The analyses are available to customers in the form of daily morning reports and cases, and weekly market updates and model portfolios.

Investtech’s algorithms for analysis, ranking and stock recommendations are based on research dating back to 1993. Part of the research was conducted in cooperation with Oslo University and the Norwegian Research Council. Research still has high priority for Investtech. Many of the company’s research results are available for customers on the company’s web site.

The company’s basic product starts at approx. 30 euro per month. Investtech also provides bespoke products for integration on partners’ web sites and for use in newsletters, for example to stock brokers and the media. Contact us by e-mail to info@investtech.com or by phone +47 21 555 888 for more information. A free trial subscription is available to order on our web site www.investtech.com.

Head Office

Investtech ASStrandveien 17

1366 Lysaker

+47 21 555 888

Postal address

Investtech ASStrandveien 17

1366 Lysaker

info@investtech.com

VAT no. 978 655 424 MVA

Research Department

Instituttveien 102007 Kjeller

www.investtech.com

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices