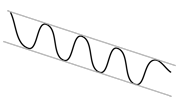

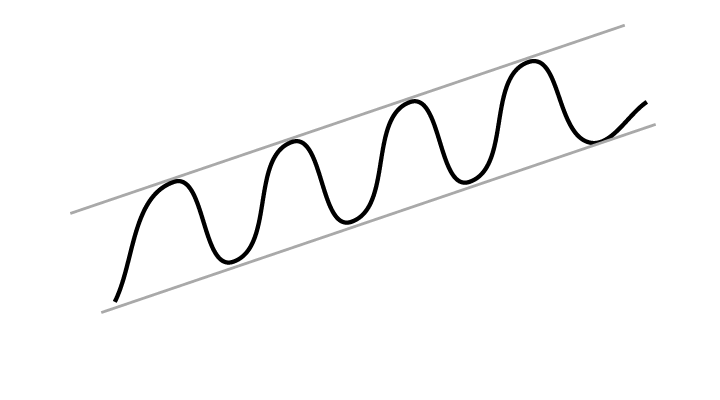

Rising trend

Rising trends indicate that the company experiences positive development and increasing buy interest among investors.

A rising trend signals that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon. If you own a stock in a rising trend, you should normally keep it. And you should consider buying stocks that are in rising trends if you are looking for new stocks to buy.

A rising trend signals that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon. If you own a stock in a rising trend, you should normally keep it. And you should consider buying stocks that are in rising trends if you are looking for new stocks to buy.

- Buy stocks in rising trends.

- Keep stocks you own while they are in rising trends.

A stock in a rising trend has investors who have become increasingly positive to the company. When this sort of movement has started among the investors, it tends to last over time. Ever more people see the positive development, make their own analyses, and thereby nurture further positive development.

The market often overreacts to short term news and underreacts to long term news. A contract today gives direct income in the short term. However, it also influences the company’s long term potential and chances of landing a new contract tomorrow. Stocks in positive trends therefore often continue to rise.

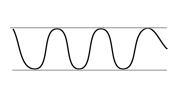

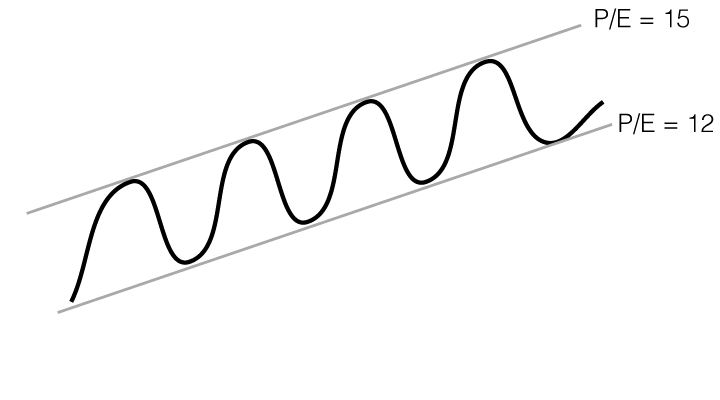

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with steady growth will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. Thus it can be advantageous to buy near the trend floor and sell near the trend ceiling. This means there is support near the trend floor and resistance near the trend ceiling.

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with steady growth will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. Thus it can be advantageous to buy near the trend floor and sell near the trend ceiling. This means there is support near the trend floor and resistance near the trend ceiling.

The figure shows a stock in a rising trend where the fundamental key figure P/E (price-to-earnings ratio) fluctuates between 12 at the trend floor and 15 at the trend ceiling.

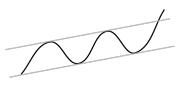

Warning signals for long term reversal downward

- Decreasing volume on rising prices and near tops.

- Increasing volume on falling prices and near bottoms.

- Price near floor, especially if the stock also sees horizontal resistance and negative volume development.

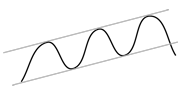

Warning signals for short term reaction downward

- Price near resistance and overbought RSI, and often negative volume development.

Should warning signals trigger a sale?

Rising trends often last longer than many investors think, and it is easy to sell too soon. However, sometimes selling at early trend reversal warning signals gives very good sales. What to do is a matter of risk assessment.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices