RSI er en god momentumindikator

Publiceret d. 5. februar 2019

Aktier, som har fået en høj RSI-værdi, over det kritiske 70-niveau, vil fortsætte med at stige fremover. Samtidig har aktier med lav RSI-værdi, under det kritiske 30-niveau, fortsat med at gøre det svagere end børsen fremover. Det viser en forskningsrapport fra Investtech baseret på 23 år med data fra Oslo Børs og 16 år med data fra Sverige, Danmark og Finland.

RSI er en flittigt benyttet indikator inden for teknisk analyse. Forkortelsen RSI står for Relative Strength Index og er et mål for, hvor godt en aktie har klaret sig målt op imod sig selv. Tallet beregnes ved at se på styrken i opgangsdagene i forhold til styrken i nedgangsdagene over en bestemt periode og får en værdi mellem 0 og 100.

Mange investorer mener, at RSI kan give indikationer for, om aktier er steget eller faldet for meget og bør reagere tilbage. Investtechs forskning foreslår, at en sådan overkøbt- oversolgt-tolkning statistisk set ikke stemmer overens med virkeligheden. Resultaterne viser, at RSI er en god indikator for, om aktien har positivt momentum eller negativt momentum, og at et sådant RSI-momentum er en god indikator for den videre kursudvikling.

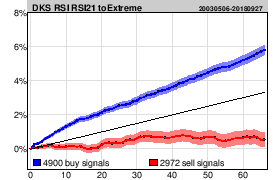

Vi har studeret 35733 tilfælde, hvor RSI21 har krydset over 70-grænsen og 23590 tilfælde, hvor RSI21 har krydset under 30-grænsen. Vi kaldte strategien RSI-momentum og satte købssignal, når RSI gik over 70 og salgssignal, når RSI gik under 30.

Figur 1. RSI21 Danmark. Kursudvikling de første 66 dage efter RSI-momentumsignaler i Danmark. Aktierne med købssignal steg i gennemsnit 5,8 procent, mens aktierne med salgssignal steg 0,5 procent. Gennemsnitlig udvikling til referenceindekset var gået 3,3 procent op.

Tabellen herunder viser den gennemsnitlige årlige merafkastning i kølvandet på RSI-momentumsignaler. Tallene er baseret på kvartalstallene dvs. afkastning 66 dage (3 måneder) efter signal.

| Årlig merafkastning | Danmark | Norge | Sverige | Finland | Vægtet gennemsnit |

| Købssignal RSI21 krydser over 70 | 10,8 %p | 14,4 %p | 6,5 %p | 6,9 %p | 9,1 %p |

| Salgssignal RSI21 krydser under 30 | -11,3 %p | -15,8 %p | -10,2 %p | -7,5 %p | -11,6 %p |

Samlet set indikerer resultaterne, at RSI egner sig godt som momentumindikator, og at investeringer baseret på købssignaler fra RSI-momentum giver en statistisk set bedre afkastning end den gennemsnitlige børsafkastning.

Du finder flere resultater og detaljer i forskningsrapporten, som du kan læse her.

Keywords: Københavns Fondsbørs,Købssignal,RSI,RSI-momentum,Salgssignal,statistik.

Written by

Head of Research and Analysis

at Investtech

"Investtech analyses the psychology of the market and gives concrete trading suggestions every day."

Partner & Senior Advisor - Investtech

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices