Insider trade analysis of stocks

Analysis of insider trades is Investtech’s alternative to fundamental analysis. When persons on a company’s Board or in management buy stocks, it signals that they think the stock is cheap. Insider sales are considered a signal that the stock is expensive or high risk.

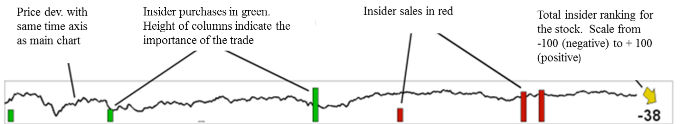

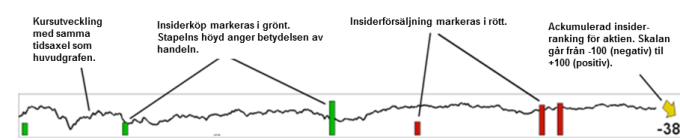

Investtech’s insider trade analyses give an overview of insider purchases and insider sales in a company over time.

Each trade is assigned an importance on a scale from 0 to 100. Big trades count more than small ones, and trades where the insiders owned few stocks to start with, are given more weight than where they owned many. An insider purchase gives a positive number and sales give a negative number.

In Norway all registered insiders are obliged to report their own trades as soon as possible, and no later than when the exchange opens the next day. Investtech evaluates all stock exchange messages and registers data on insider trades. The insider trade analysis for Swedish stocks is based on the insider transactions reported

to the Swedish Financial Supervisory Authority’s Insider Register.

Based on all reported insider trades in a company, Investtech’s systems assign the stock an insider ranking on the scale -100 to +100. Stocks with an insider ranking of 50 or higher are considered buy candidates based on insider trades. Insider rankings from 25 to 50 are considered weak buy candidates. Similarly, negative insider rankings are

considered sell candidates.

Explanation of table with insider trades

The trades in this table are the ones in the chart above.

| Field | Description |

| Date | Date the trade was reported |

| Type | Type of transaction |

| Count | Number of stocks |

| Price | The buying/selling price for the stocks |

| Value | Value of the trade in NOK/SEK 1000 |

| Percent | Value of the trade in percentage of the insider's total holding in the stock |

| Controlled | Number of stocks the insider owns after the transaction |

| Text | Short text describing the transaction. Purchases in green, sales in red. |

| Importance | The importance of the trade, calculated based on the amount of money traded for and the insider's change of stock ownership in percent. The scale goes from 0 (= unimportant) to 100 (=important). |

Insynsköp som indikator för kommande kursutveckling i aktien

Publicerad 31 maj 2019

Aktier med insynsköp har igenomsnitt presterat bättre än referensindexet under perioden efter insynsköpet, och aktier med insynsförsäljning har i genomsnitt presterat sämre än referensindexet under perioden efter insynsförsäljningen. Det visar en forskningsrapport från Investtech baserat på 20 år med data från Oslo Börs och 16 år med data från Stockholmsbørsen.

Analys av insynsaffärer är Investtechs alternativ till fundamental analys. När en person i bolagets styrelse eller management köper aktier, är det en signal om att denne anser aktien är billig. Insynsförsäljning betraktas som en signal om att aktien är dyr eller att risken är hög.

Investtechs insynshandelsanalyser ger översikt över insynsköp och insynsförsäljningar i ett bolag över tid.

Läs mer om analys av insynsaffärer på våra hjälpsidor här.

Resultat insynsköp

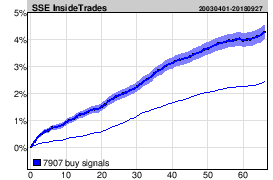

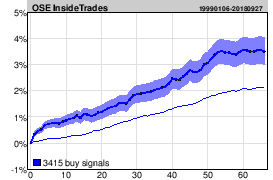

Figur 1: Kursutveckling första 66 dagarna efter insynsköp.

Grafen visar genomsnittlig kursutveckling efter insynsköp i Sverige och Norge. Affärerna rapporterades före börsens stängningstid på dag 0. Endast dagar då börsen är öppen ingår, så att 66 dagar motsvarar cirka tre månader. Den tjocka blå linjen visar hur aktier med insynsköp i genomsnitt har utvecklats. Det skuggade området anger standardavvikelsen till beräkningarna. Den tunna blå linjen är genomsnittlig utveckling för referensindexet under samma period.

| 66-dagars-siffror | Sverige | Norge | Viktat snitt |

| Köpsignaler | 4,3 % | 3,5 % | 4,0 % |

| Referensindex under samma period | 2,4 % | 2,2 % | 2,3 % |

| Meravkastning köpsignal | 1,8 %e | 1,4 %e | 1,7 %e |

| Annualiserad | |||

| Köpsignal | 17,3 % | 14,1 % | 16,3 % |

| Referensindex under samma period | 9,6 % | 8,5 % | 9,2 % |

| Meravkastning köpsignal | 7,7 %e | 5,7 %e | 7,2 %e |

Tabellen visar annualiserad avkastning och annualiserad meravkastning i procentenheter, betecknat %e.

Vi ser att insynsköp både i Sverige och Norge har följts av en positiv avkastning kommande månaderna. I Sverige var uppgången 4,3 procent och i Norge 3,5 procent, som ger ett viktat snitt på 4,0 procent. Annualiserad avkastning är 16,3 procent, motsvarande en meravkastning på 7,2 procentenheter mot referensindexet under samma period.

Vi såg också att aktier med insynsköp i genomsnitt hade fallit under perioden före köpet. Motsatt hade aktier med insynsförsäljning stigit under perioden före försäljningen. Dessa observationer är en indikation på att insynspersoner köper när de anser aktien är fundamentalt billig, och har fallit mer än den förtjänat, samtidigt som insynspersonerna säljer när de anser aktien har stigit för mycket och har blivit fundamentalt dyr. Investtechs insynshandelanalys kan därmed betraktas som en enkel fundamental analys av aktien.

Du hittar fler resultat och detaljer i forskningsrapporten som du kan läsa här.

Insider Purchase

When primary insiders in a company buy stocks, it may be a signal that the stock is fundamentally cheap.

When primary insiders in a company buy stocks, it may be a signal that the stock is fundamentally cheap.

When someone on a company’s Board or a member of Management buys stocks, it signals that they think the stock price will rise. The primary insider may feel that the market has punished the stock too hard following negative news or that the market fails to sufficiently value positive news. It may also be the case that the company’s outlook is good and/or that the insider believes the purchase risk is low.

In general, we want to side with the primary insiders. It is considered safer to buy a stock that the company’s directors or management have purchased recently than a similar stock without insider trades.

Investtech Research: Insider Purchase

Stocks with these positive signals have on average outperformed the market in the following months. Annualised excess return has been 8.1 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Positive signals medium term | 19.0% |

| Reference index | 10.9% |

| Excess return | 8.1pp |

The research results are based on 9837 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Article: Innsidekjøp som indikator for videre kursutvikling i aksjen

- Research Report: Innsidehandler - signalstatistikk Norge, Sverige og Danmark 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Innsidehandler under koronapandemien

- Research Report: Investtech-forskning: Innsidehandel - signalstatistikk Skandinavia 2008 til 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Kursoppgang etter innsidekjøp

Insider Sale

Sales by primary insiders in a company may be a signal that the stock is fundamentally expensive.

Sales by primary insiders in a company may be a signal that the stock is fundamentally expensive.

When someone on a company’s Board or a member of Management sells stocks, it may be a signal that they are afraid the stock price will fall. The primary insider may think the stock has risen too much compared to the development and potential of the company, or that the market has failed to sufficiently take into account increased risk or negative news. It may also be the case that the company’s or sector’s outlook has been weakened or that the insider believes risk is high.

If the insider only sells a smaller share of their stocks, they may want to reduce risk in their own portfolio. Sales may also occur because an insider needs cash for something else or has found a better investment opportunity. In general, it is considered a negative signal when primary insiders sell stocks in their company. It is considered safer to buy a stock where directors or management have purchased stocks recently than similar stocks where insiders have recently sold.

Investtech Research: Insider Sale

Stocks with these negative signal have on average underperformed compared to benchmark in the following months. Annualised return has been 1.8 percentage points (pp) weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Negative signal medium term | 8.0% |

| Reference index | 9.7% |

| Excess return | -1.8pp |

The research results are based on 5158 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Article: Innsidesalg som indikator for videre kursutvikling i aksjen

- Research Report: Innsidehandler - signalstatistikk Norge, Sverige og Danmark 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Innsidehandler under koronapandemien

- Research Report: Investtech-forskning: Innsidehandel - signalstatistikk Skandinavia 2008 til 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Kursoppgang etter innsidekjøp

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices