Global stocks: Two buy and one sell

Published December 4, 2019

We took a trip to India last week and wrote about a few heavyweights that were driving the Indian stock markets to new highs. We return back to the US markets and will write about three stocks taken from the Stock selection category that Investtech provides. You can filter through some given parameters and get your own customized list of stocks. What we have today is two buy and one sell.

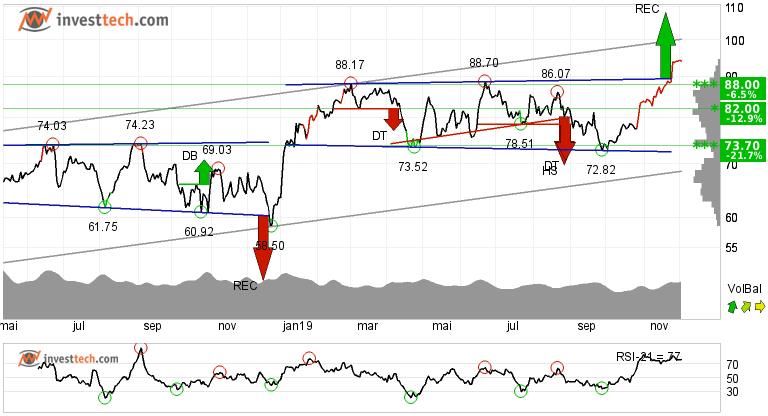

Merck & Co Inc (MRK.US500) Close: 87.38

Merck & Co. Inc. is inside a rising trend channel in the medium term. Rising trends show that investors over time have bought the stock at higher prices and indicate good development for the company. Since its bottom in early 2018, the stock has gone up consistently and has gained over 63 per cent.

Merck & Co. Inc. is one of the world's largest pharmaceutical companies and recently the stock gave a positive signal from a rectangle formation at the break up through the resistance at 86.93 dollars. Further rise to 94.03 or more is signalled. The stock has marginally broken up through the resistance at 86.70 dollars. An established break predicts a further rise. There is support around 80 dollars.

The short term momentum indicator RSI is above 70 after a good price increase the past weeks. The short term volume balance indicator is also positive which indicates that more and more investors are now interested in buying the stock. The stock has strong positive momentum and further increase is indicated.

Investtech's outlook (one to six months): Positive

Incyte Corp. (INCY.US500) Close: 94.10

Investors have paid higher prices over time to buy Incyte Corp. and the stock is in a rising trend channel in the short, medium and long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing.

The healthcare and biotech company has recently given a buy signal by closing above the resistance of 88 dollars and has initiated a buy through a breakout from the ceiling of a rectangle formation both in the medium and long term charts. Further rise to 108 dollars or more is indicated. In case of any reaction on the downside, there is support around 88 and 82 dollars respectively.

Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. RSI is above 70 after a good price increase the past weeks. The stock has strong positive momentum and further increase is indicated.

Investtech's outlook (one to six months): Positive

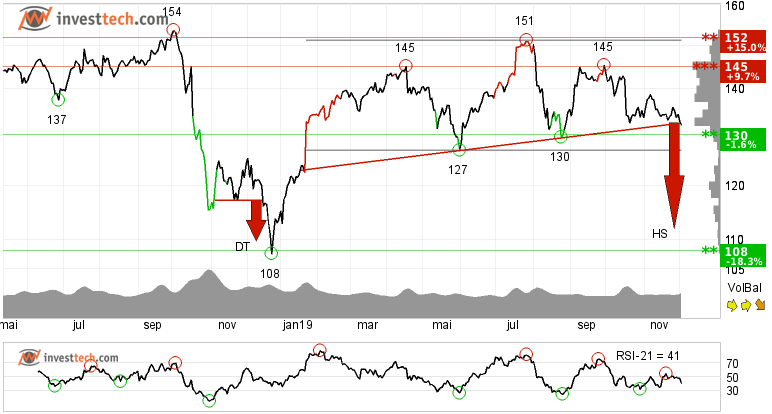

IBM (IBM.US500) Close: 132.12

IBM is within an approximate horizontal trend channel in the medium term and is inside a downward trend channel both in the short and long term charts. The stock has marginally closed below the neckline of the head and shoulders formation. An established break below yesterday's close, preferably on higher volume, will initiate a new sell signal.

The stock has some support around 130 dollars, but long term investors seem to be impatient as the volume balance indicator is turning down. Further down the line, next support is around 108 dollars. The stock has resistance around 145 dollars.

Investtech's outlook (one to six months): Negative

The analyses are based on closing price as per December 04, 2019.

These instruments are traded in currency based on the Exchange or country they are listed on.

Skrevet av

Analytiker

i Investtech

"Investtech analyserer psykologien i markedet og gir deg konkrete tradingforslag hver dag."

Partner & Senior Advisor - Investtech

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Investeringsanbefalingen(e) er utarbeidet av Investtech.com AS ("Investtech"). Investtech garanterer ikke fullstendigheten eller riktigheten av analysen. Eventuell eksponering i henhold til rådene / signalene som fremkommer i analysene står fullt og helt for investors regning og risiko. Investtech er ikke ansvarlig for noe tap, verken direkte eller indirekte, som oppstår som en følge av bruk av Investtechs analyser. Opplysninger om eventuelle interessekonflikter vil alltid fremgå av investeringsanbefalingen. Ytterligere informasjon om Investtechs analyser finnes på informasjonssiden.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices